FoodTech 2024 in Review: Embracing Wave 3.0 of FoodTech Innovation

As we reflect on the FoodTech landscape of 2024, one thing becomes abundantly clear: we’re witnessing the emergence of a new paradigm in FoodTech innovation. Despite challenging market conditions, the industry is pivoting toward more sustainable, systemic, and impactful approaches. This transformation—what we’re calling “Wave 3.0″—is reshaping how entrepreneurs, investors, and established players collaborate to build the future of food.

The Investment Reality Check

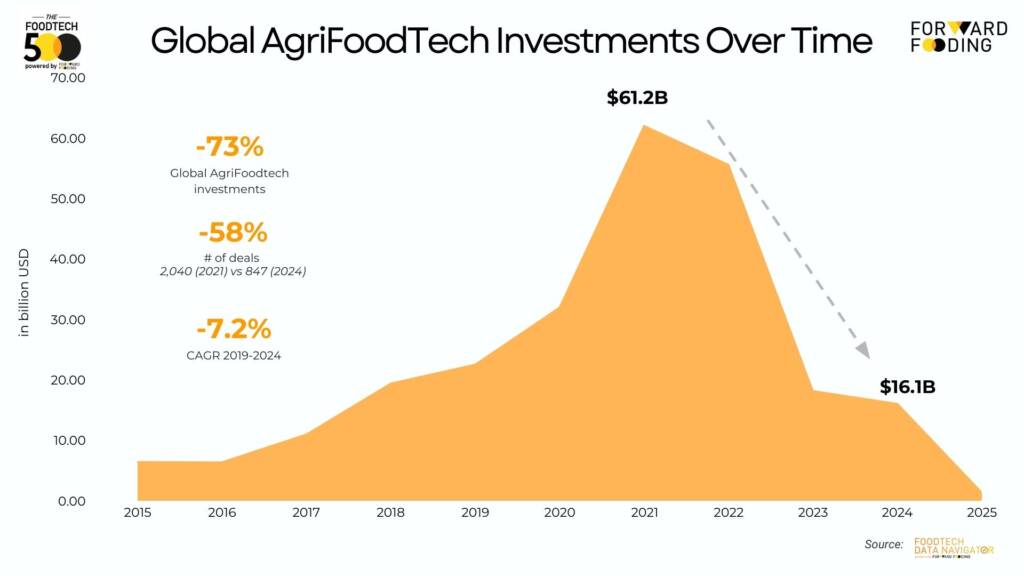

The numbers paint a sobering picture: global AgriFoodTech investments have experienced a dramatic 73% drop since 2021, plummeting from $61.2 billion to just $16.1 billion in 2024.

The downturn is not merely a matter of reduced capital; it extends to the very structure of investment. Deal volume has decreased substantially, falling from 2,040 in 2021 to 847 in 2024, representing a 58% reduction. Interestingly, median deal size, excluding rounds over $100 million, increased from $3 million to $5 million. This indicates a shift towards larger, more selective investments.

Conversely, pre-seed and seed deals, crucial for early-stage innovation, now constitute 28% of total deals, down from 36% in 2021. This decline in early-stage funding raises concerns about the future innovation pipeline and highlights the growing importance of alternative financing strategies.

The rise in debt financing from 3% to 7% and grant funding from 6% to 9% reflects this diversification, as founders navigate a more challenging venture capital environment. It is important to remember that these percentages are of a much smaller funding pool.

Notably, once-dominant sectors like Food Delivery and Alternative Proteins have seen their share of funding shrink from 68% to 47%, signaling a significant shift in investor priorities and a move away from the hyper-growth models of previous years.

This recalibration signals more than just a cyclical downturn—it indicates a fundamental reevaluation of how innovation in food systems should be funded and scaled.

A New Funding Distribution

The reallocation of investment across different subsectors tells a compelling story about where the market sees future value. The following figures represent the share of global AgriFoodTech funding allocated to each subsector, comparing 2021 to 2024:

- Ag Biotech: 3.8% (2021) → 6.2% (2024)

- Farm Management & Precision Farming: 2.7% (2021) → 6.6% (2024)

- Protein Fermentation: 2.3% (2021) → 3.4% (2024)

- Biotech/Synthetisation: 3.9% (2021) → 5.1% (2024)

- Upcycled Ingredients, Food Surplus & Waste Efficiency: 1.3% (2021) → 2.5% (2024)

These shifts reveal investor confidence in upstream technologies and circular approaches, even as the overall funding pool has contracted. Importantly, these percentage increases represent a reallocation of priorities rather than absolute growth—a recalibration toward a new ‘Wave’ of innovations.

FoodTech Wave 3.0: Four Growth Domains Reshaping Food Innovation

What exactly is Wave 3.0 in FoodTech? It represents a circular and systemic approach to innovation that transcends the limitations of previous iterations.

Wave 1.0 focused primarily on digitizing food services and distribution, giving us food delivery platforms and restaurant marketplaces. Wave 2.0 introduced novel foods and alternative proteins, capturing imaginations with plant-based meats and cellular agriculture. While these waves created value, they often addressed isolated parts of the food system.

Wave 3.0 takes a more holistic view, recognizing that the greatest challenges—and opportunities—lie in reimagining how our entire food system functions. It emphasizes:

- Circular approaches that eliminate waste and create value from byproducts

- Biotech innovations that work with natural systems rather than against them

- Technologies that connect different parts of the value chain

- Solutions that simultaneously address environmental, health, and economic impacts

Our analysis of FoodTech 500 data reveals four key areas with substantial company activity and continued growth despite the broader funding contraction:

1. Ag Biotech (550+ Companies, $1.13B+ in 2024)

With an 8% CAGR from 2019-2024 (compared to -4.65% for the global ecosystem), agricultural biotechnology is fundamentally reimagining how we grow food. These technologies address agriculture’s environmental footprint while improving productivity—a dual impact that characterizes Wave 3.0 innovations.

From enhancing carbon sequestration in agricultural systems to promoting soil health and developing bio-engineered crops with improved resilience, Ag Biotech represents a transformative approach to sustainable food production.

2. (Bio)tech-enabled Food Manufacturing (480+ Companies, $1.19B+ in 2024)

Showing exceptional growth at 23% CAGR, this sector leverages biology to transform food creation through bio-engineered specialty ingredients, functionally improved alternative proteins using novel technologies, and AI-powered food processing systems that optimize production.

By producing food components in controlled environments, these approaches offer dramatic sustainability improvements while potentially enhancing nutritional profiles and functional properties.

3. Food as Medicine & Personalised Nutrition (645+ Companies, $1B+ in 2024)

Growing at 14% CAGR, this domain recognizes that food’s relationship with health extends beyond basic nutrition. Innovations targeting gut health and microbiome, solutions supporting cognitive health and performance, personalized nutrition platforms tailoring recommendations to individual needs, and specialized supplements and additives with targeted health benefits are reshaping how we think about nutrition.

As healthcare systems globally shift toward preventative approaches, the intersection of nutrition and health represents one of the most promising frontiers in food innovation.

4. Sustainable Ingredients & Circularity (550+ Companies, $884M+ in 2024)

With a solid 12% CAGR, this sector embodies the circular principles central to Wave 3.0. Upcycling solutions transform byproducts into valuable ingredients, sustainable packaging innovations reduce environmental impact, technologies extending shelf life decrease food waste, and novel sustainable ingredients improve functional properties.

These innovations close loops within the food system, transforming what was once considered waste into valuable resources while reducing environmental impacts.

Hard Lessons Learned in 2024

The emergence of Wave 3.0 hasn’t come without pain. As we explored in our analysis of AgriFoodTech battles in 2024, the industry has moved from inflated expectations to grounded realities. Early reliance on VC-backed hypergrowth models frequently led to unsustainable businesses chasing scale before establishing viable unit economics.

While early-stage investments remain relatively robust, later-stage funding has become significantly more selective, with investors demanding clear paths to profitability. Successful companies have maintained lean operations while diversifying funding strategies beyond traditional VC.

The sector has increasingly embraced collaboration over competition, with partnerships between startups and established players becoming essential. Perhaps most notably, timing has played an outsized role in recent company failures, with otherwise promising ventures faltering because they sought capital at the wrong moment.

Looking Ahead: 2025 and Beyond

To successfully navigate the current challenges and capitalize on the opportunities presented by Wave 3.0, several key factors will be essential:

- Strategic Capital Diversification: Expanding beyond traditional venture capital to include debt financing, grants, and strategic partnerships will be crucial for sustainable growth, while VC will need to adapt its model to become more aligned with expectations in terms of time to market, scalability and ROI timelines, especially for deeptech and biotechnologies.

- Robust Corporate and Startup Collaborations: Fostering strong partnerships between established food companies and innovative startups will accelerate the adoption of Wave 3.0 technologies.

- Adaptive Regulatory Frameworks: Policies that support circularity, sustainability, and technological innovation will create a favorable environment for FoodTech growth.

- Focus on Real-World Application and Scalability: Prioritizing solutions that demonstrate clear pathways to practical implementation and market adoption will be vital.

While the market is showing signs of stabilization, it’s important to acknowledge that the path to full commercial readiness varies significantly across sectors. While some areas have seen increased maturity, others are still in early development.

When considering valuations, entrepreneurs should focus on realistic, data-driven assessments that reflect current market conditions and long-term viability, rather than relying on the inflated valuations of previous years.

Could we expect a gradual funding recovery in 2025? This is too early to say, but given 2024 investments almost reached a ‘plateau’, we could expect a slow rebound in investments, especially in the above-mentioned areas. As we move into 2025, the groundwork laid this year positions the FoodTech ecosystem for more sustainable growth. The challenges facing our global food system—from climate impacts to resource constraints to evolving consumer needs—remain urgent. Wave 3.0 innovations provide pathways to address these challenges while creating long-term value.

The opportunities have never been greater for those with the vision to embrace this new paradigm.

Want to discover which companies are leading the Wave 3.0 revolution? Subscribe to our newsletter to receive the full FoodTech 500 ranking when it drops next week!

Forward Fooding is the world’s first collaborative platform for the Food & Beverage industry via FoodTech Data Intelligence and Corporate-Startup Collaboration – Learn more about our Consultancy and Scouting Services and our Startup Network.

This post FoodTech 2024 in Review: Embracing Wave 3.0 of FoodTech Innovation appeared first on Forward Fooding – Powering the Food & Food Tech revolution!.

Post Comment